SaaS Positioning

Why Positioning Your SaaS Correctly Is Key To Unlocking New Growth

"Market 8 is really a partner with us. They have gotten us unstuck from a plain product positioning to an exciting one, targeting a market that really cares, where we can clearly win."

Raven 360

Think back to when you started your company; when you saw a gap in the market; when you identified a problem.

Maybe you were facing a specific problem yourself and learned that others were facing the exact same issue. You were smart enough to spot a trend and bold enough to fulfill a need.

You took the lead and – lo and behold – your SaaS was born!

But time has passed and you're getting ready to take the next step – to grow your product and service. There are new challenges to navigate – competitors, evolving technologies, shifting client expectations, among other things.

So how do you differentiate your SaaS? By positioning it correctly.

Sure, that’s a big task in itself – which is what we’ll delve into here – but it begins by being able to honestly answer one simple question:

Does your SaaS really matter to your users?

More Than Marketing

Let’s be clear: product positioning isn’t brand positioning or clever communications. Product positioning goes beyond sassy straplines or well-thought-out web content. It’s the strategic step that comes before all of that.

Positioning secures a place in your customer’s mind. It’s about reframing the original reason you created the company. It means knowing *exactly* where your SaaS fits into your customers’ lives – understanding which problems it solves, what the extent of those problems are, who in the company is having them, as well as what’s important to them, and where it sits alongside competitors.

Knowing what these insights are will help you position your SaaS correctly to address your target audience. But it can’t be done in isolation. What you need to successfully position your business is actual customer feedback.

This means asking some tough questions (for you, not them!), but ultimately, the aim is to find out how much customers really care about your SaaS – and being brave enough to use that as a foundation to adjust your market positioning.

After all, a business can survive without most things – a board, investment, or even an exit strategy. But unless it has a market that really, really cares, it will never be successful.

Positioning is key for your business.

Deconstructing Positioning

In a nutshell, positioning stems from several things:

| a) what product or service you're offering |

b) who you’re offering it to |

c) how it’s different and/or better than others |

d) why your product or service matters |

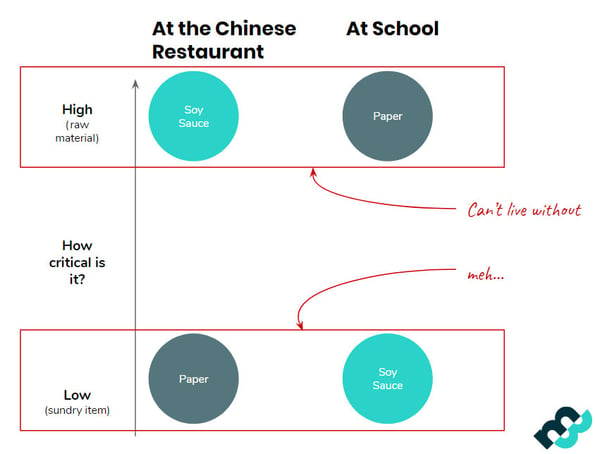

There are numerous ways to approach these criteria, but a good way into this is via an example I like to use – ‘the Soy Sauce vs. Letter Size Paper Test’ (stay with me on this…).

Soy Sauce vs. Letter Size Paper

If you were to rank how critical both of these products are, from low to high, soy sauce would score pretty highly in a Chinese restaurant but pretty low in a high school. But rank paper in the same two environments and you have the complete opposite situation.

Why is this the case? Because the customers in both examples have different priorities. True, they could be the same people in different scenarios, but we need to understand that context is what matters.

In terms of positioning, the problem you're solving has to be number one or number two priority for your users – whether that’s flavoring food or writing term papers. If it doesn’t address these priorities, your product will be ignored.

"You can have the best quality product in the world, but if it’s not seen as a priority for your customers, well, you’re not positioning it effectively."

Problem Category Spectrum

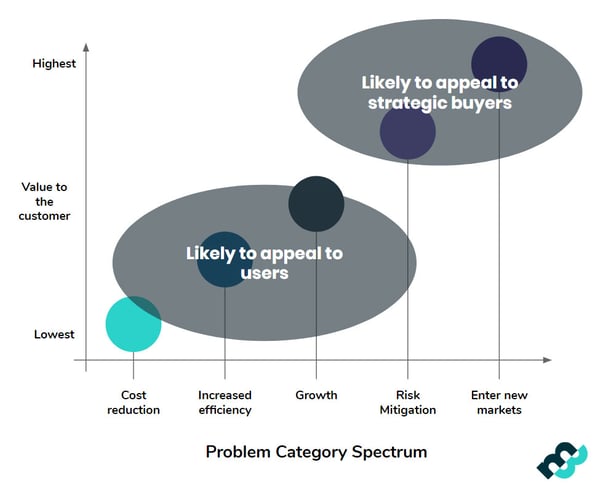

In this chart , the vertical axis indicates value to the customer – from lowest to highest – while the horizontal axis shows common customer problems.

Think about the main reasons businesses buy SaaS products. At the lowest end of the spectrum is cost reduction. It’s not that it isn't important, but when compared to other reasons why businesses buy a SaaS product, cutting costs isn’t a priority use case for most.

Next, is increased efficiency, followed by growth. These are user-led problems, which product-led companies are good at addressing. But by doing so they’re focusing on lower-level value propositions – which aren’t all that profitable.

Sales-led companies are those that appeal to the strategic buyers, which they do by addressing higher-level problem categories – such as risk mitigation and entering new markets.

But if, as a SaaS company, you are product-led, how can you transcend lower-level value categories? There are two approaches.

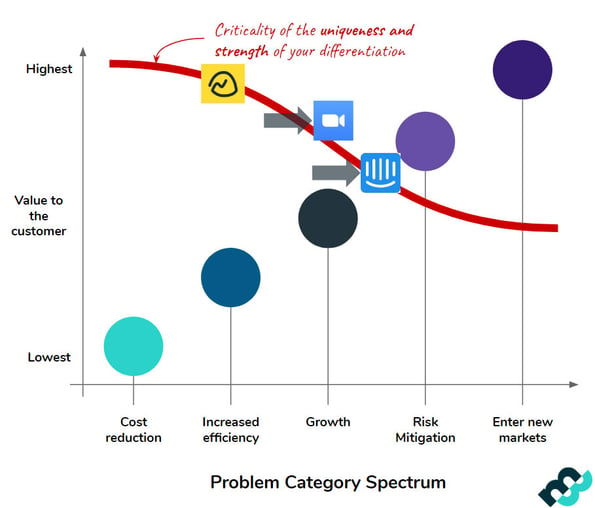

#1 Dramatic Differentiation

Firstly, you can develop a more dramatic differentiation strategy. Say you’re focused on cost reduction. To excel and get noticed, your brand would need to be different and better than the competition, which – given how arbitrary these criteria are – is difficult to get right. However, it is possible.

Basecamp is one company that’s done this effectively. While its focus is increased efficiency, it’s very different from anything else in the market.

Differentiation can also elevate your product towards solving higher-value problems. A great example of a brand who’s managed to do this successfully is Zoom. Although the company started out with an increased efficiency value proposition, during the COVID-19 lockdown, as businesses operated remotely, Zoom successfully positioned itself as a risk mitigation and business continuity solution – the upshot of which saw an 80% increase in its stock between January and April 2020.

#1 Thing you can do

If your positioning targets low category problems you need even More, DRAMATIC differentiation.

Similarly, Intercom, a chat tool, and communications tool, is moving from a growth tool into a risk mitigation platform.

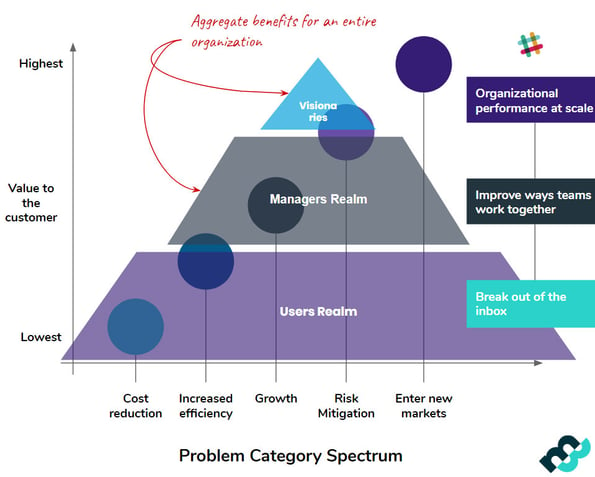

#2 Extrapolate The Value For Visionaries

The second part of this involves extrapolating the value for visionary leaders in larger organizations. But what does this actually mean?

Essentially, it involves overlaying a hierarchy of needs within a large company, and positioning your product to those at the top of the pyramid (see below): the leaders or ‘visionaries’ as well as management level decision makers – without isolating the broader user base.

Basically, the aim is to find a way to communicate the different operational and strategic benefits of your SaaS. For users, cost reduction and increased efficiency might be important. But if you're targeting managers, addressing middle-level issues like growth and risk mitigation is important. And for visionaries entering new markets is going to be crucial.

#2 Thing you can do

Extrapolate your value for visionary leaders in larger organizations

What’s important here is accentuating the ‘through line’ between each group. Slack does this very well. For users, it’s an email killer. For managers, the message is about improving the ways teams work together. And for visionaries, the focus is on organizational performance at scale.

Designing Your SaaS Positioning Framework

Once you have the logic behind your positioning aligned and know where you want to be, it’s time to create your SaaS positioning framework. Here at Market8, we have our own approach to positioning – that’s designed exclusively for SaaS companies.

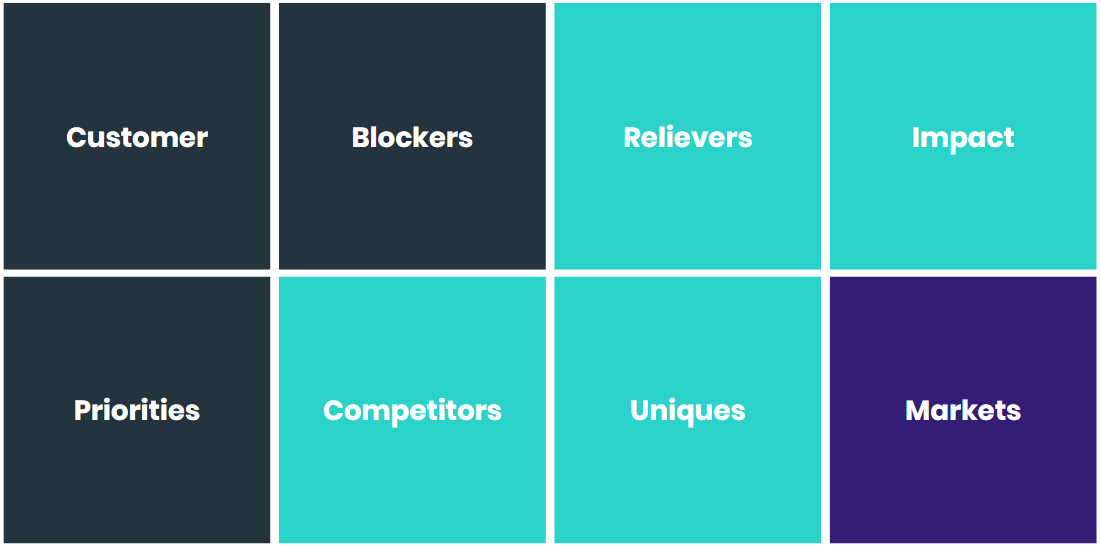

The M8 Positioning Framework

As you can see, there are three dark green blocks, four-light green blocks, and a single purple block.

Dark Green blocksSignify the Customer, what their Priorities are, and what the Blockers to those Priorities are.

|

Light Green blocksMeans knowing the Competitors offering alternatives to your product, understanding how your product’s features act as Relievers to the Blockers you defined, identifying what truly differentiates your SaaS product– it Uniques – and what Impact your SaaS is accomplishing.

|

Purple blockUnderstanding Markets means asking if the Impact that your SaaS is accomplishing is aligned with the Priorities of your customer profile.

|

Framework In Action

To illustrate these things we’ll use a fictitious SaaS company – DATASYNC – which has a system that automatically captures sales reps' activity data, emails, meetings, and logs them in a CRM automatically. It then surfaces back enriched data to sales reps through their email via a smart algorithm.

Let’s take a closer look at each of these section-by-section.

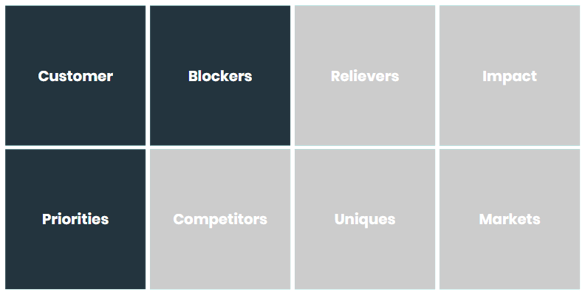

Part 1 - SaaS Positioning Framework

The Customer

1.1- Who's the customer

1.2- What are their priorities

1.3- What blocks them

The Customer

Customer

We need to identify who the ideal customer profile is, so we need to ask some key questions: Which customer group has the highest profits? Which has the shortest sales cycle? Which has the quickest adoption rate? Which costs less to serve?

For DATASYNC, their ideal customers are B2B sales reps in organizations of 20 salespeople, who use LinkedIn, Salesforce, and have a complex email server setup.

However, to find this information – and the answers to these questions – you have to look back at your data. You have to talk to sales and customer success teams and get as much insight as possible.

The Customer

Priorities

What are the customer’s priorities and what do they need to do to achieve them? To understand this, you need to ask: What jobs are you responsible for accomplishing? What are your objectives? How are you measured? Once you understand the priorities, you need to rank them in terms of importance.

For DATASYNC sales reps, the biggest priority is achieving their monthly/quarterly/annual quotas, while the least important is keeping client records updated in the CRM.

THE CUSTOMER

Blockers

What are the biggest challenges customers face while working on their top priorities? Here we start with the top blocker to the top priority and work our way down – sorting pain points from most to least painful.

At DATASYNC, the top blocker is a lack of leads, while the bottom blocker is spending too much time on admin and data entry.

Some research questions to ask include:

-What are the top challenges you face while working on your top priority?

-What was the problem you were trying to solve when you bought our solution?

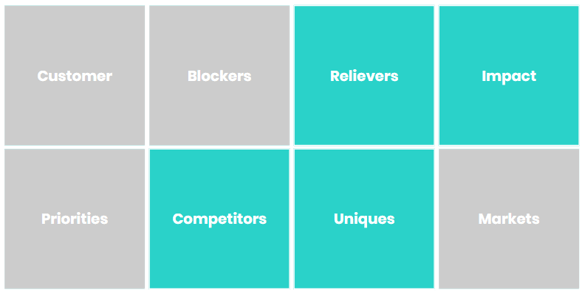

Part 2 - SaaS Positioning Framework

The Solutions

2.1- Competitor/alternatives

2.2- Product relievers

2.3- Product unique advantages

2.4- Impact of the solution

The Solutions

Competitors

Competitors aren’t just those with something similar to your business in the same space, it also means those offering alternatives to your product – eg if you have a project management SaaS, you can regard Excel as a competitor product as it can cater to your users’ needs, even though it isn’t positioned for that purpose.

Understanding the alternatives means asking customers: How are you solving your problem today? How were you accomplishing XYZ? How were you solving this problem before buying our SaaS: Which alternatives did you consider before buying our solution?

At DATASYNC, the alternatives are spending hours on LinkedIn manually. Using unreliable tools for manual data entry.

The Solutions

Relievers

Here you need to find out exactly what your product can do to relieve those blockers. Be realistic about what your product does – this will help you identify some gaps, which you can then prioritize in your roadmap.

Key research questions include: What problems do the product actually help you solve? Which features have proven more useful? Why? How does the product help you overcome XYZ challenges?

For DATASYNC users, enriching prospect data in their email is one major reliever, as is automatic sales activity data.

THE SOLUTIONS

Uniques

What is it about your product and solution that is more unique, better, and more powerful in the eyes of your customer? You need to find out – which factor customers consider when buying it, why they chose your solution over alternatives, and what they think it does better than alternatives.

DATASYNC offers reliable access to enriched prospect data and transparent bug-free data capture.

The Solutions

Impact

You need to uncover what is the ultimate outcome customers are accomplishing with your SaaS and how it helps them accomplish that.

Some questions you can ask are: What outcomes does this product help you accomplish? How? Why does that matter? How do you measure success?

DATASYNC helps sales reps know exactly how to prioritize their work and reduce admin time by 50%.

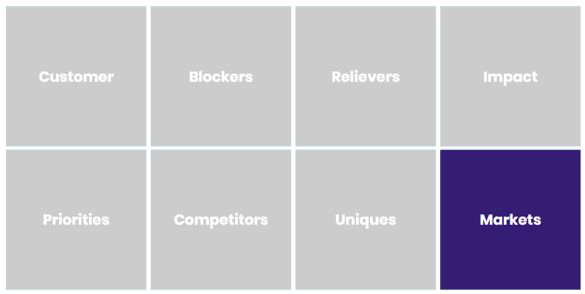

Part 3 - SaaS Positioning Framework

The Market

In this final stage, you have to think about finding that one market or niche where your product matters the most. In short, you need to determine in which contexts your product is most relevant.

You can do this by asking:

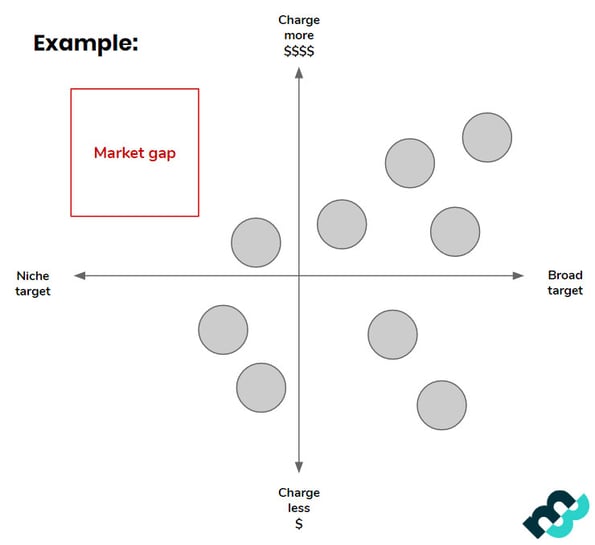

Target vs Price

If there is – say you go after a specific vertical or solve a particular use case – and you specialize in it, you can charge more money and own that niche.

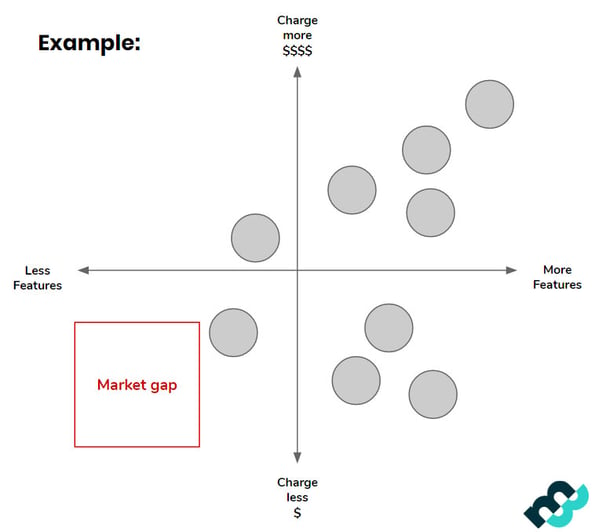

Price vs Quality

Similarly, if you were to chart your competitors in terms of price and quality, you’d need to know which are more expensive and which have the features. By doing this you can see where your SaaS sits where the gaps in the market are.

So, returning to our fictitious DATASYNC. In the beginning, it was positioned as just a sales activity DATASYNC tool. It was broad, diluted, undifferentiated and it didn’t highlight any of the priorities in the problem category spectrum.

But, through understanding its positioning, we can justifiably identify it as a customer intelligence tool – one that helps sales reps acquire customer insights, prospect better and achieve their quota.

However, that’s very much a user-focused strategy. By also positioning DATASYNC as a way to gather data in order to validate forecast accuracy, it becomes a risk mitigation strategy – putting it in a higher-level value category without isolating users from its day-to-day operational use. And because it offers reliability and speed of access in complex IT environments, it’s suitable for enterprise customers.

Hopefully, it’s clear that you have to bring all of these insights together into the framework and look at everything to see the natural order of things. The key thing is not to force this, and almost address each blog independently, so you can really identify the gaps.

Ultimately, positioning paints a clear picture of your SaaS for your customers. But if it isn’t clear to you, you’re going to confuse the heck out of everybody else. This is why it’s so crucial that you involve customers and don’t try to define what your SaaS does in a vacuum.

After all; you’ve already bought into the idea. Precise positioning will make sure everybody else does.